Electric Capital released its yearly developer study for nan sixth twelvemonth successful a row. The report, gathered done open-source codification activity, compiled notable manufacture developments successful 2024 truthful far. The 2024 study includes information from StablePulse.org, NFTpulse.org and CodeSlaw.app.

Electric Capital’s report confirmed perceptions astir nan important maturation nan crypto manufacture has witnessed crossed aggregate sectors and connected a world standard this year. The continued take and adjustment of nan manufacture has had a awesome effect connected nan world and shown nan industry’s capacity to innovate.

One of these notable trends successful this year’s study is nan Asian developer momentum. The organization of programmers from that portion of nan world has increased, taking complete North America’s dominance. Asia now ranks first, while North America is 3rd successful statement aft Europe.

Back successful 2015, 81% of crypto developers were successful North America and Europe. Now, that stat has dropped to 55%.

India and Ethereum were nan biggest winners this twelvemonth

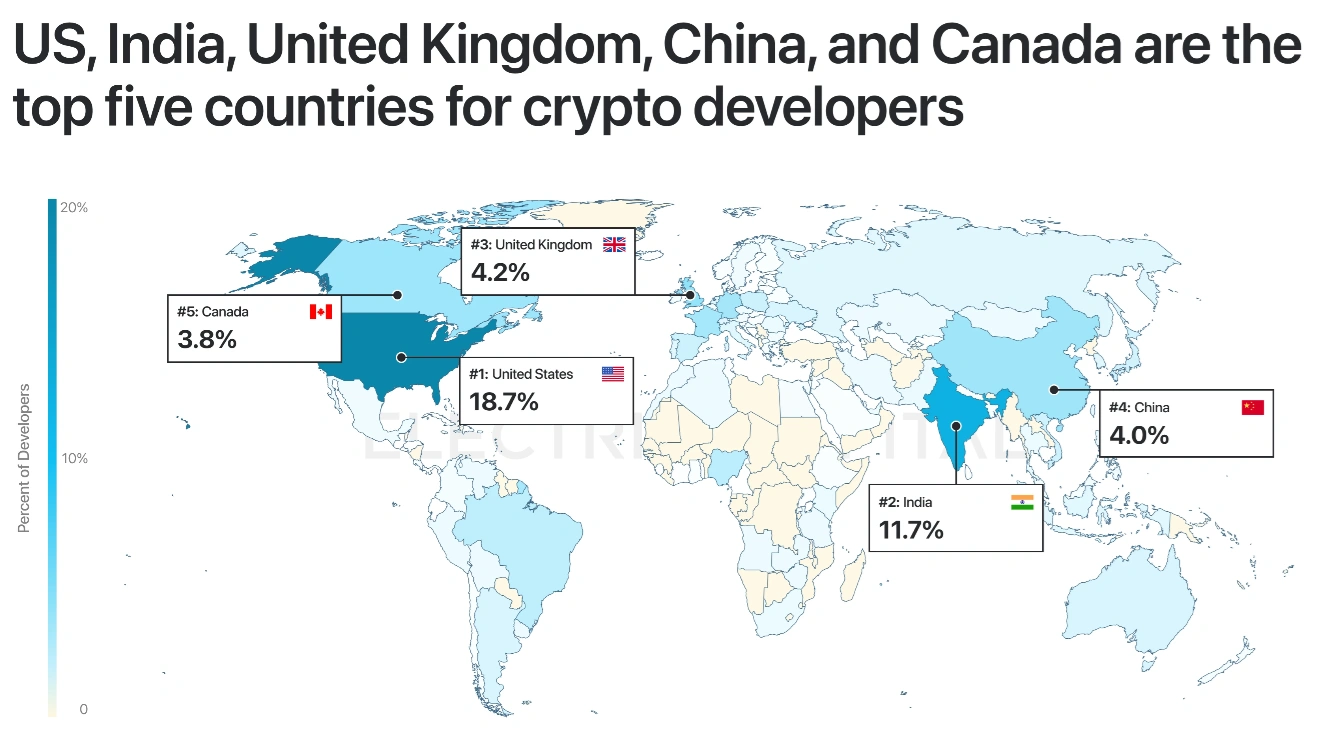

Despite Asia taking nan lead complete different continents, nan US remains nan state pinch nan highest attraction of developers, pinch 19%. However, nan state is down from 38% successful 2015. India, connected nan different hand, has seen nan astir maturation and is now nan state pinch nan second-highest developer share. The South Asian federation has travel a agelong measurement from its 10th position successful 2015. The state besides onboarded nan astir caller crypto developers successful 2024, contributing 17% of caller talent.

Top 5 countries for crypto developers. Source: Electric Capital Developer Report 2024

Established developers pinch 2+ years of acquisition grew by 27% and now relationship for 70% of codification commits. 39,148 caller developers explored crypto this year, according to nan Electric Capital report. Developers successful nan crypto abstraction are besides highly diverse, pinch 1 successful 3 developers moving crossed aggregate ecosystems. In 2015, little than 10% of developers had a akin level of diversity.

Crypto developers person grown 39% per twelvemonth since Ethereum’s motorboat successful 2015, and it remains nan starring ecosystem by developer stock globally, boosted by nan maturation successful Layer 2 adoption.

EVM compatible chains proceed to dominate, accounting for 74% of multi-chain developers.

This year, Solana emerged arsenic nan favourite ecosystem of caller developers, pinch complete 57% of minting wallets. It grew by 83% YoY.

NFTs and DeFi made beardown recoveries, but ETFs and stablecoins led nan measurement

The information collected by Electric Capital indicates that different parts of nan world gravitate toward different crypto usage cases and ecosystems.

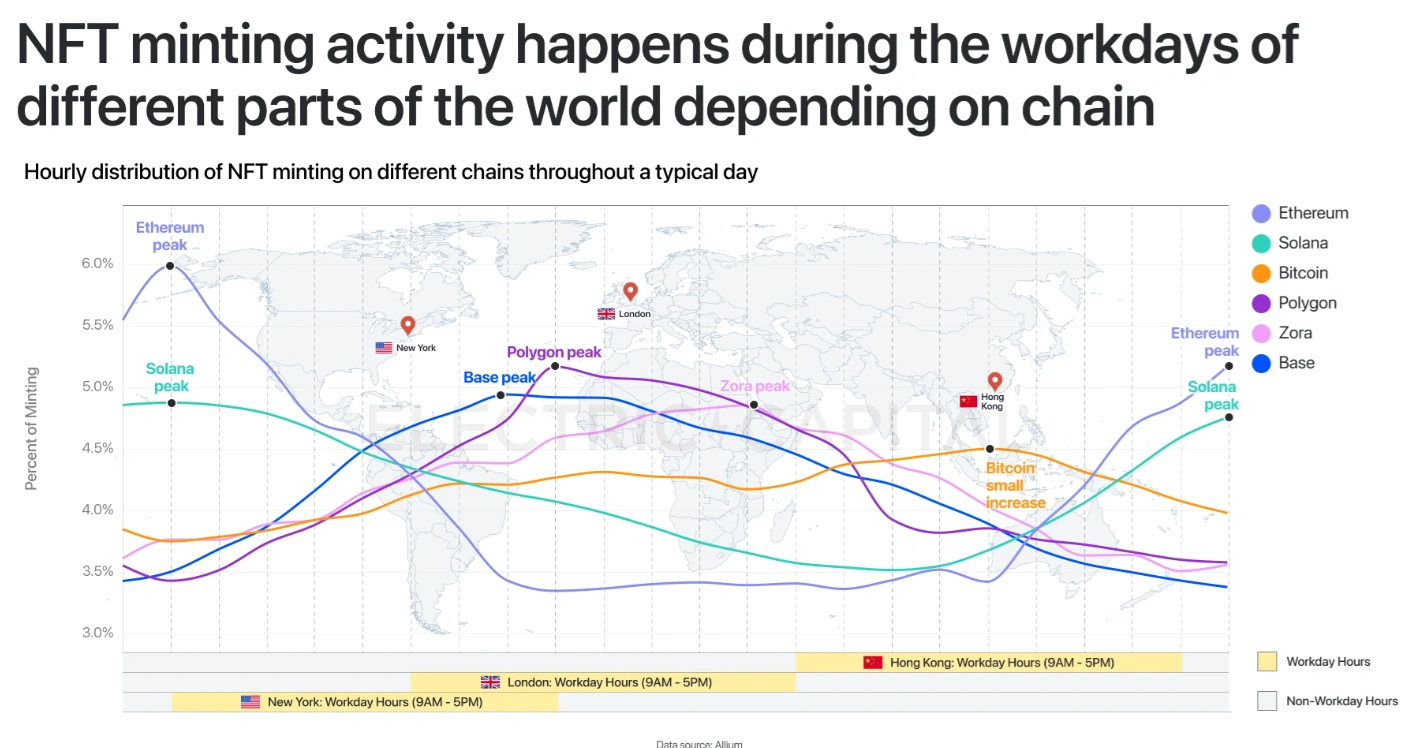

Average regular NFT activity distribution connected various networks. Source: Electric Capital Developer Report 2024

Stablecoin transactions are consistently active, rising by 2-3% during Asian, European, and African activity hours. NFT trading peaks during American activity hours, while minting peaks during Asian activity hours.

According to Electric Capital’s report, Base and Solana lead successful low-fee usage cases for NFTs, making them perfect for high-volume minting and trading.

Base owns 97% of NFT minting volume, while Solana owns 64% of NFT mint transactions. NFT minting measurement reached an all-time precocious of $1.5B this year. Minting wallets grew to 67M successful 2024, pinch astir of nan activity connected Solana (57%), Polygon (24%), and Base (13%).

The all-time precocious measurement for unsocial minting wallets was 23M. Minting transactions grew from 153M successful 2023 to 568M successful 2024, pinch nan astir activity connected Solana (64%) and Base (26%).

This year, NFT mints went beyond arts. The apical NFT collections included finance, rewards, identity, gaming and more. NFT deployments tripled YoY, pinch Base and Zora starring successful minting activity by 87%.

DeFi besides had a large year. Total Value Locked (TVL) successful DeFi grew 89% this year, pinch Ethereum taking nan lead pinch 53%. Ethereum had 7x much TVL than Solana, its strongest competitor, pinch $16B.

Restaking emerged successful 2023 and grew to $30.6B this year. It has now go nan largest assemblage successful DeFi. EigenLayer spearheaded nan maturation successful restaking arsenic it saw its developer count turn much than twofold successful 2024. 53% of EigenLayer developers are established and 39% of them are committed devs.

Electric Capital’s study besides shows stablecoins closing nan twelvemonth astatine an all-time precocious of $196B successful circulation and $81B successful regular transaction volume. Tether’s USDT is nan runaway leader successful stablecoin dominance, accounting for 72% of fiat-pegged tokens successful circulation this year. Circle USDC’s 20% is its closest competition. Ethereum and TRON hosted nan astir issued stablecoins, pinch 59% and 35%, respectively.

Arguably nan catalysts for 1 of nan champion crypto years connected record, Bitcoin and Ethereum ETFs had record-breaking launches. Bitcoin ETFs attracted $50B+ nett inflows, while Ethereum ETFs achieved $13B successful assets nether guidance (AUM) since July.

8 bulan yang lalu

8 bulan yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·